What is the minimum cost of living in London? Find out how what the cost for accommodation, food, bills, transport, and activities in London are.

There are many activities to do and people to meet in London. In fact, London is a super diverse city which attracts people from all over the world. However, the large growing population and cost of living are some drawbacks for living in the capital.

After living in London for almost 10 years and I keep being amazed by how expensive London is. I have had friends asking me how it is to work and live here which pushed me to make this blog. This blog is a factual guide that will cover how much money you will need to live in London based on personal observations and research. The topics covered include:

If you have any other tips or facts to share don't forget to leave them in the comments at the end of the blog =).

There are over 8.8 million people living in London and population keeps increasing every year. For this reason, the cost of living in the capital continues to increase as the demand grows.

According to Rightmove, the average price for a flat in London is £533,891, with terraced and semi-detached properties being around £800,000. It is very unlikely to find properties in a good condition for less than half a million...

The amount of rent to pay for an accomodation in London mainly depends on:

A realistic summary of the average rents in London:

Bills usually include water, electricity, gas, council tax, WiFi, TV licensing and landline if any. More are covered below in this blog. You should expect to spend at least £160pm on bills.

Council Tax:

Council Tax usually varies depending on the London borough and property band. It is managed by the London Councils and the easiest way to find out is probably by asking your landlord how much you will have to contribute (I would personally expect £90-120pm if you are by yourself).

The Council Tax bands range A to H and is based on the property size, location, layaout, market value and other attributes. For example, you can pay around £915 anully for a Band D property in the City of London or £2,409pa for a Band E property in Havering.

Income Tax:

Income Tax is how much tax you pay from your salary. If you earn less than £12,571 you pay 0%, and if you earn between £12,571 and £50,270 you will pay 20% of whatever amount you earn above £12,571. You can check more income taxes in the gov.uk web.

National Insurance:

National Insurance (NI) is another tax on earnings that you will have to pay if you earn over £242 per week (£1,048pm). You will have to pay 13.2% of the amount you earn over the £242. You can check how much you pay in the gov.uk web.

This really depends on your diet, dietary requirements and how many people you plan to share food with. The cost of groceries is the same everywhere in the UK for established supermarket brands (e.g. Tesco, Asda, Sainsbury's, etc.).

I personally spend around £60 every two weeks for two people in Lidl for large grocery shopping + any essentials in the local Tesco (£10-15 per week) if I run out. So in general, an expected estimate for the cost of groceries in London could be around £80-100 per month per person.

When eating out, you can find meals for £7.50-£11 per person on single £ restaurants (e.g. food markets, fast food restaurants), or £14-20 per person on bigger (££) restaurants.

London underground (aka 'tube') stations are well connected so cars are not really necessary unless you need it for work. You can also pay with a contactless card or Oyster card.

Here is a summary of the cost of public transport:

Walking and cycling are free, so if you can walk or cycle to commute you will save a lot of money per month.

If you do not use public transport everyday, you can use pay as you go with your normal Oyster card or contactless card and spend around £10-15 per week for 6-9 journeys. As a rule of thumb, expect to spend MINIMUM £50 per month on transport.

Here is a list of the usual cost of memberships, activities and other good and services in London:

Didn't you add up your costs of living in London? That's fine, here is a summary of the monthly cost of living in this big city for an individual person with examples at the end:

Renting a Property (bills not included)

Bills, Taxes & Utilities (check your tenancy agreement)

Food & Transport

Other Expenses

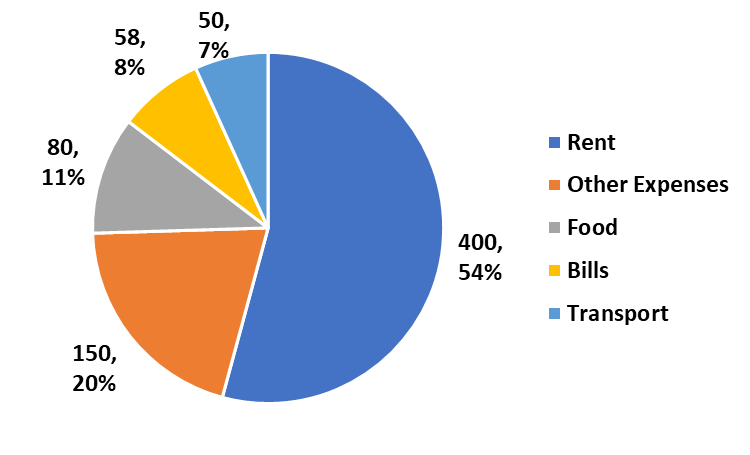

Alan is a blogger who lives in London. He shares a property in Zones 2 with 3 other people and the bill does not include water and TV license cost. Alan goes out twice a week with friends and has multiple enternaining accounts:

Minimum cost of living in London for Alan

= Rent + Bills + Food + Transport + Others

= £400 + (£11+£8+£9+£30) + £80 + £50 + (£15x2x4 + 30)

= £738pm

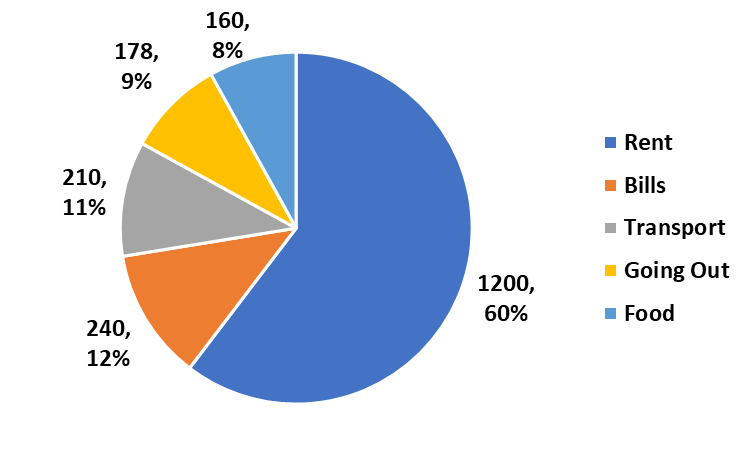

Jerry and Kate are a couple who recently move to London. Jerry works as a chef in the city center and Kate is a self-employed consultant. They have a one-room flat borderline Zone 2-3 and go out for dates (food and drinks) twice a month. Kate likes to go gym when she is free. They both share enternaining platforms.

Minimum cost of living in London for Jerry and Kate

= Rent + Bills + Food + Transport + Others

= £1,200 + £240 + £160 + (£160+£50) + (£20+£15x2x2+£12x2x2+£20+£30)

= £1,988pm (or ~£1,000pm each)

London life is expensive and it is hard to enjoy if you are constantly worried about money. Here are a few tips and things to consider if you plan to move here:

Last tip!

Since everyone is and behaves differently, I recommend doing this calculation with your own salary or expected salary and decide whether or not living in London is suitable for you:

Let's say that you earn the minimum national wage of £9.50ph and have a full-time (40h) job. That means that your yearly salary is £18,240 before taxes (around £16,360 after taxes). If you spend £1,000pm based on the examples above, you will end up spending £12,000 per year. This will leave you £4,360 in a year to save, invest, spend on holidays, more goods or other things. Will this be enough for you?

I hope this blog helps you with any upcoming decision or knowing more about life in London. If you have any other tip or fact to share feel free to leave them in the comments =).

Want to know what to do on your next trip? Explore our growing blogs in our MapScratched Travel Blogs site and use the filters that we provide to plan your trips faster.

If you want to become an author FOR FREE and share your travel experiences with other adventurers, make sure you fill in our very short travel author form.